Tips for deciding how much to contribute to your FSA/HSA

Whether you get health coverage through your employer or through your state’s health benefit exchange, you have choices to make every year. During your enrollment period, you can pick a plan that’s right for you and your family — and you may be able to save money by setting up a flexible spending account (FSA) or health savings account (HSA).

What are FSAs and HSAs? FSAs and HSAs are a way to set dollars aside before taxes to help pay for your out-of-pocket medical costs. You can use this money for your share of expenses that aren’t covered by your health plan — like copays for doctor and dentist visits, prescriptions, and eyeglasses — as well as for over-the-counter drugs and many personal care products. Not all employers offer FSAs, and HSAs are only available with a high deductible health plan (HDHP).

How much should I contribute to my FSA/HSA?

Estimate your health expenses for next year

Estimate how much money you and your family usually spend out of pocket on health expenses each year. Think of the care you’re likely to get, and how much it typically costs you after insurance. Answer these questions to help you do the math:

- How many times do you visit a doctor? What is your copay/coinsurance? (Learn more about important health care terms, including copays and coinsurance.)

- Do you take prescription medication?

- Do you regularly take over-the-counter medications, like ibuprofen and antihistamines?

- How many times do you get your teeth cleaned?

- Do you wear eyeglasses or contact lenses?

- Do you sometimes visit an acupuncturist, chiropractor, or mental health therapist?

Are you planning any elective health procedures next year? If so, request an estimated cost from your care provider. (If you’re a Kaiser Permanente member, you can use our treatment cost calculator to estimate how much you would pay out of pocket on your current plan.) Here are some examples of expenses you can plan for:

- Joint replacement surgery

- Inpatient alcohol or drug addiction treatment

- Dental braces

- Vision corrective surgery

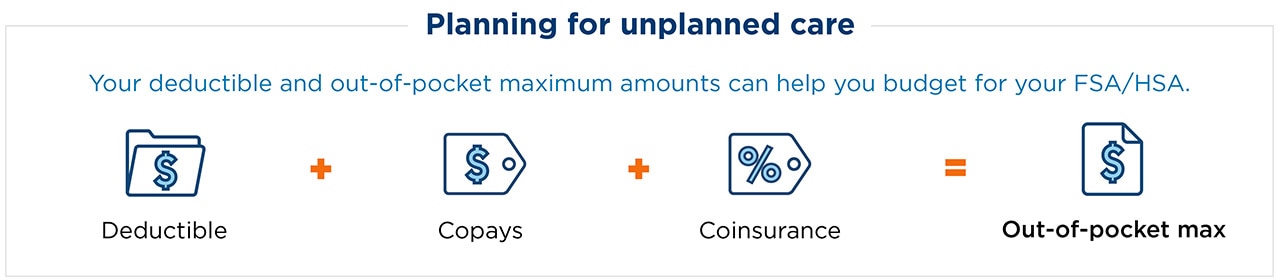

Consider what you might have to pay for any unexpected health costs. Obviously, accidents and unforeseen health issues are hard to plan for. The simplest way to estimate this is by using your annual deductible and out-of-pocket maximum.

- Deductible — How much you’ll have to spend out of pocket for covered services before your plan starts to pay.

- Out-of-pocket maximum — The most you’ll have to spend for most covered services in a year before your health plan covers 100% of your medical expenses. It includes your deductible and other costs your health plan doesn’t cover — your copays and coinsurance.

The federal government sets out-of-pocket maximum limits each year under the Affordable Care Act. If you have any questions about your plan’s limits, contact your employer or your health plan coverage documents. Keep in mind that your out-of-pocket maximum may be more than you’re allowed to contribute to your FSA/HSA — we’ll review contribution limits below.

As you move into the next step in planning, you now have a range of amounts to consider — from covering some of your known routine care needs, to setting aside the total amount you think you might spend out of pocket next year.

Determine your contribution amount

Know your limits

FSAs and HSAs have minimum and maximum amounts that you’re allowed to contribute. Your employer (for an FSA) or financial institution (for an HSA) decides their minimum contributions — for example, $100. The federal government decides HSA maximum amounts. The government also sets a maximum FSA contribution, but your employer can set a lower contribution limit for their employees.

Note: if both your and your spouse’s employers offer an FSA, you may each be able to set up an account and contribute to the maximum amount. Here are the maximum contribution amounts for 2024:

- FSA maximum — $3,200 or lower, depending on employer

- HSA maximum, individual — $4,150

- HSA maximum, family — $8,300

When you turn 55, you can make catch-up contributions to your HSA. You can contribute an additional $1,000 each year until you’re enrolled in Medicare. To learn more about contributions, see IRS Publication 969 or talk with your tax advisor. If you have any questions about your plan’s limits, contact your employer or financial institution.

Find your comfort zone

If this is the first time you’re contributing to an FSA/HSA and you aren’t sure how much you wish to contribute, here are a few ways to approach it:

If you’re still unsure about how much money to contribute, try setting a health care budget . Your budget can also include how much you expect to spend each month on your health plan.

Track your out-of-pocket expenses throughout the year

What if I don’t have enough money in the account?

Maybe you need to visit the doctor more than you expected to, or your dental bills are higher than you planned for. If you have an HSA, you can increase your contribution amount anytime during the year, up to the annual limit. If you have an FSA, you can use this information to plan next year’s contributions.

What if I have money left over?

Set a calendar reminder for late in the year, like October. If you have money left that you don’t expect to spend on health care, you can use it to buy eligible items with your plan’s debit card at an FSA store or HSA store. Stock up on eligible items you use all the time, like contact lens solution and bandages.

Remember, if you have an HSA account, you can choose to leave that money for your future health care costs. It may earn interest and, over time, reduce the amount you need to save.

No matter how much you set aside, starting an FSA or HSA is a smart way to pay for health expenses for you and your family.

Learn more about affordable health insurance

Learn simple ways to save money and get the most out of your coverage.

How to compare plans and choose one that’s in your budget.

Learn how high deductible plans work and decide if one makes sense for you.

Learn more about Kaiser Permanente

Compare all our health plan options, get a quote, and apply online.

Find top-notch doctors, specialists, and pharmacies near you.

We’re uniquely designed to support your total health.